1/3/2020

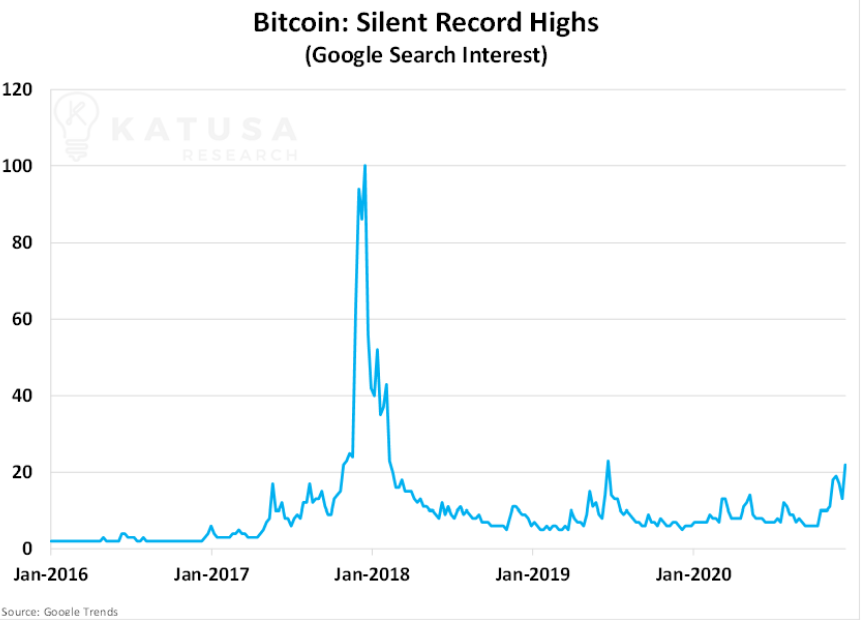

What a month for bitcoin. It reached $34,000 this morning and according to the chart below it is hardly trending on google trends i think you are defiantly chasing right now. Enter with extreme caution. That being said, I believe it is going much higher over the next decade.

8/13/2020

Massive storms rolled through Iowa last week. That being said, yields on this years corn crop is going to take a hit. CORN was able to hold its previous low of $11.50 and is starting to move higher.

6/28/2020

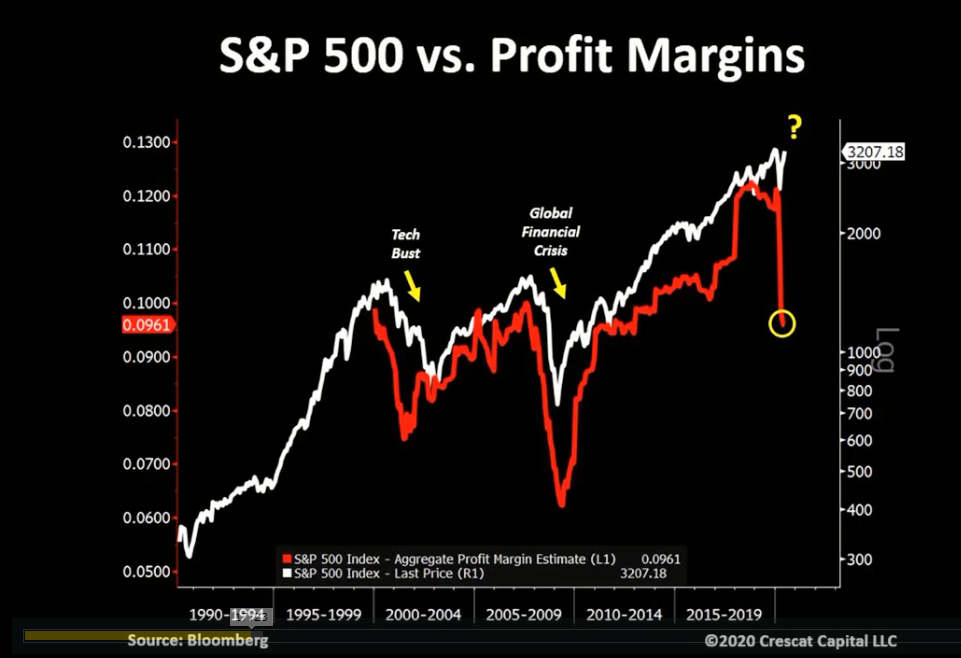

Crest Capital LLC created a chart that compare the S&P 500 to their profit margins. Before the tech bust in 2000 and the financial crisis in 2008 there was a sharp decline in profit margins. For the first time in 12 years profit margin is dropping rapidly.

5/5/2020

On May 3rd, Will Meade former Goldman Sachs PM and hedge fund manager wrote a letter to his family members and posted it on twitter. I have found Will to be a great live time resource to what is happening in the markets.

4/9/2020

During The Great Depression there were three moves to the downside. During this downturn he have experienced two. If history repeats SPY could correct 30%. That means it would be price at 2000. Time will tell. The Fed has moved over 2.5 trillion dollars onto the balance sheet and loans are being put on hold. We are in uncharted territory here.

3/22/2020

The Fed balance sheet sits at $4.67 trillion dollars. Who knows where this round of money printing will end. That being said, in 2009 the money came in and the stock market began to rise. Again in 2012 cheap money appeared and the market took off. Will the same thing happen in 2020?

3/7/2020

Another hard week for the overall market. I would guess we have not seen the bottom of this correction yet. Airline and oil stocks have been hit very hard. It looks like Diamond Offshore (DO) is getting ready to break through $2.00 per share in the coming week.

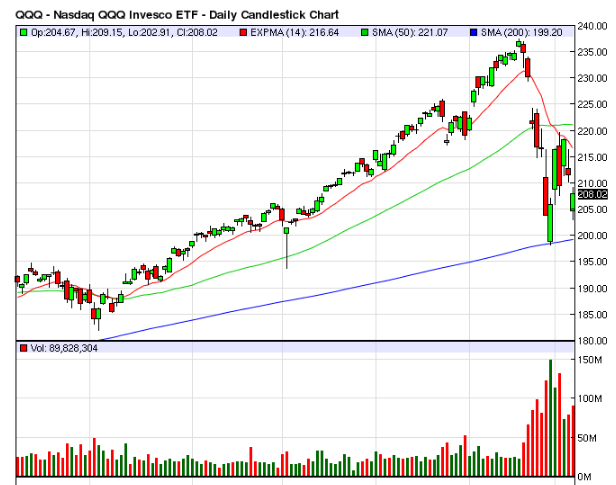

There seems to be some strength in the tech market. The NASDQ etf QQQ remains above its 200 day moving average.

3/1/2020

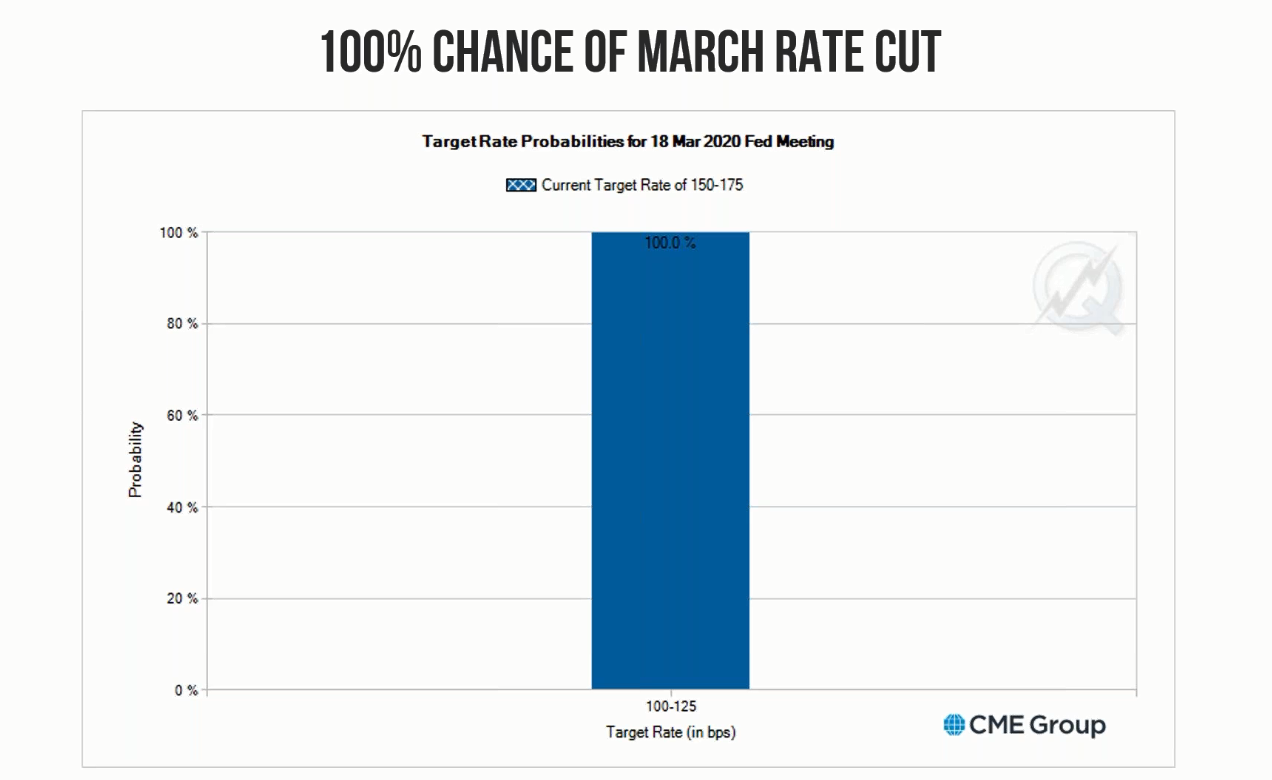

Last weeks selloff was historical. At the same time I wouldn’t say it is time to throw the towel in on this market uptrend. In mid-March the Fed is going to meet and it is 100% likely they are going to cut rates. I would think a 50 basis rate cut is in store. I would say it is time to focus on the Nasdaq and Chinese markets.

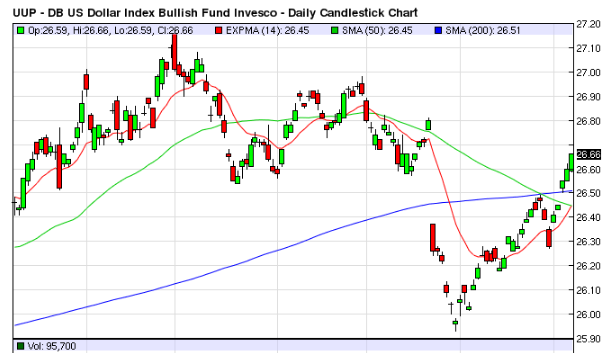

2/9/2020

UUP is a ticker you can you to track the US dollar. Last week, UUP broke above its 200 day moving average. This could put pressure on commodities going forward.

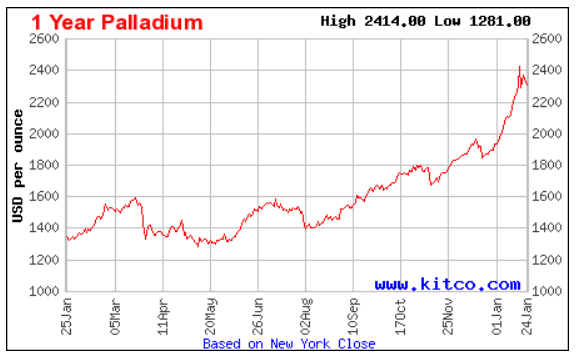

1/25/2020

Platinum has been in a steady uptrend since early last Summer. It closed this week at $1004 per ounce. Palladium closed the week at $2297. I believe platinum will soon replace palladium for the manufacturing catalytic converters. Platinum is 40 times rarer than gold.

1/4/2020

The buying volume has picked up in MJ in the November and December months. Encouraging to see after this nine month sell off.

12/21/2019

QE4. What would the economy/markets look like if QE never occurred?

12/15/2019

An industry that has the potential to grow 37 fold in the coming years. Every speculator is eyeing this market, even if they hate it. The Farm Bill gave farmers the option to replace tobacco with hemp.

12/5/2019

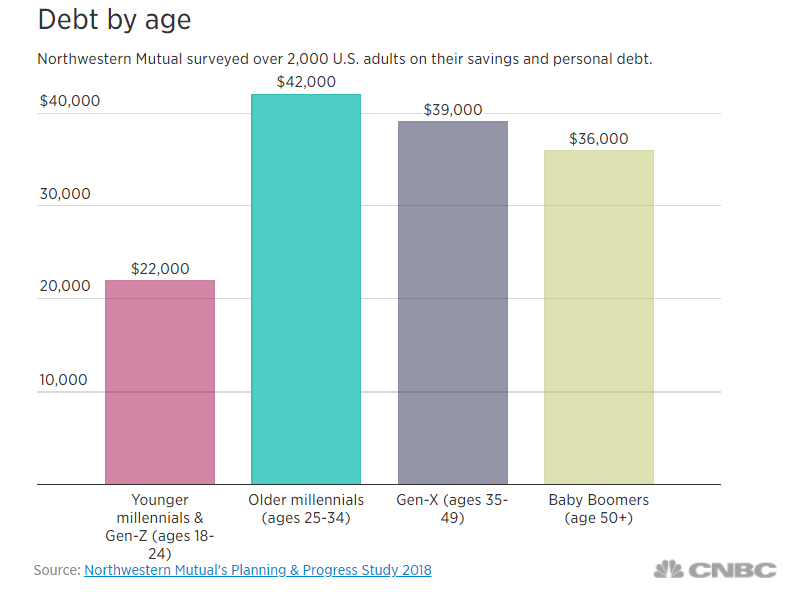

Sound money would reverse this trend. The millions of people just getting by today would have a decent lifestyle. The result of fiat money and cheap credit.

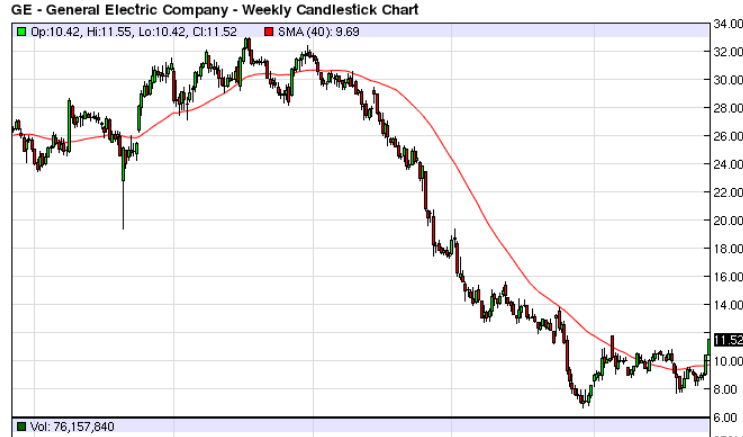

11/10/2019

General Electric is breaking out above a flat 200 day moving average. On good volume the past couple of weeks. The past three years have been tough on GE. Fed rate cuts and QE might give stock the boost it needs to break out.

11/3/2019

Kraft Heinz has been in a downtrend for the past two year. Massive debt loads have taken a toll on KHC. Late last week it broke above its 200 moving average on massive volume. It currently pays a 5.61% dividend.

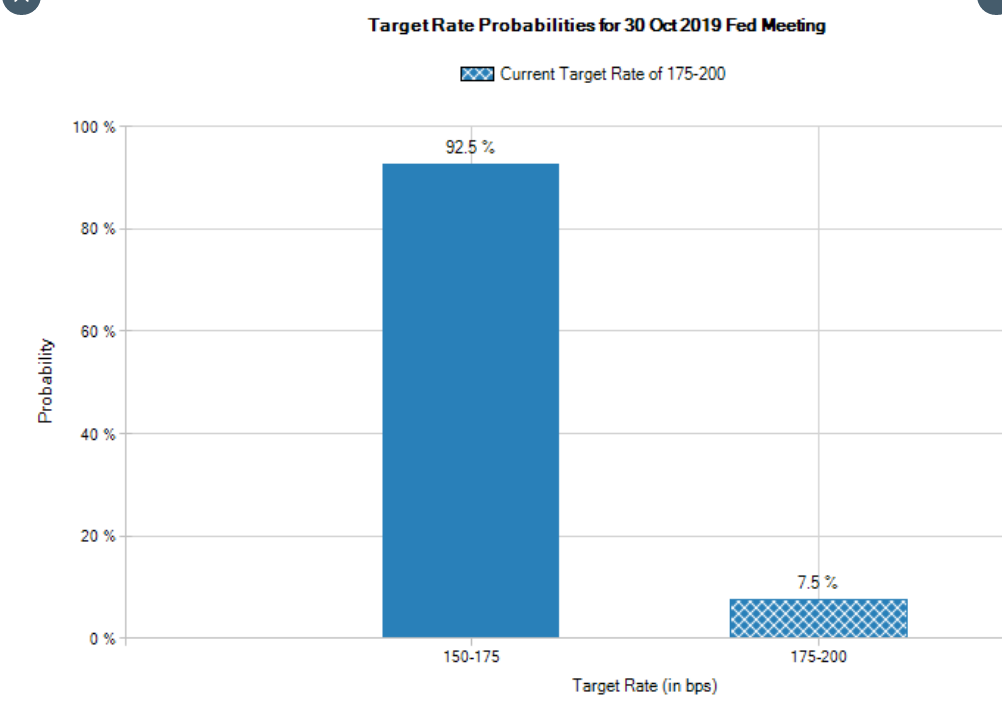

10/5/2019

Odds of a federal reserve rate cut in October 2019 jump to 93%. Odds of a 4th rate cut in December currently stand at 50%. The cheap money game is back in play.

9/5/2019

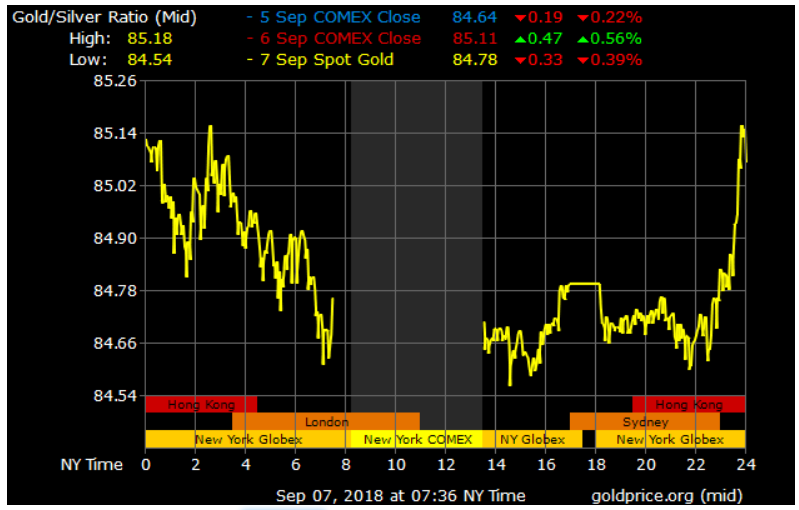

I think in the future we will look at the chart below and ask ourselves why we were not building bigger positions in commodities. My friend Steve Penny posted this on twitter this week. The reversal is going to be unbelievable when investors take their wealth and put it in something tangle instead of paper.

8/23/2019

(SH) the S&P 500 short shares has had a steady stream of buying for the moth of August. Today SH had its highest traded volume day in over six months. It appears to be setting up a reverse head and shoulders pattern. It is the wild west in the markets with the fed on one side, china on the other side and President Trump tweeting. If the S&P breaks below its 200 day moving average SH will be the beneficiary.

7/28/2019

Water ETF FT (FIW) has been in a steady uptrend since it put a double bottom in at the beginning of 2016. This weekend I noticed a few water stocks that may make good entry for swing trades. I think in the long run water stocks are headed higher as the world population grows and clean water drinking sources diminish.

7/14/2019

Alternative Harvest ETF (MJ) has been in a downtrend since late March. Last week the loses accelerated with MJ closing the week down 7%. I would like to see this etf hit the $26 handle. If a bottom sets in before that level I will be waiting to buy.

6/29/2019

Aberdeen Standard Physical Platinum (PPLT) tested and held $75 again. It then broke above its 200 day moving average with five times its normal trading volume. Platinum's spot price is $834 and gold is $1408. In the past 10 years the gold to platinum ratio has been 1:1

5/27/2019

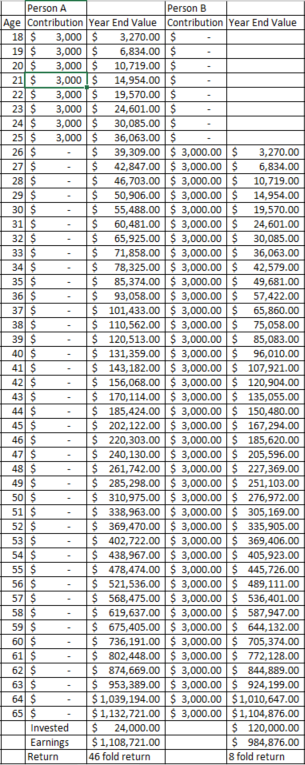

With all the young adults graduating from high school this month, I think it is important they see this chart and keep it in mind as the peruse their careers. It is amazing that saving $3,000 for 8 years and letting it compound at 9% until the age of 65 turns into over one million dollars.

5/9/2019

Overstock.com Inc has updated its infrastructure so it can transact in different crypto currencies. In the crypto mania in 2017 OSTK gained over 600% from its June low. Recently Overstock held its previous low and has broken above its 14 EMA. With the crypto market starting to warm up OSTK is a stock to keep on your radar.

4/28/2019

The solar etf TAN has put in a double bottom and the end of 2018 and has been steadily climbing since. If it can take out its previous high at $27.07 there is room to run. Below is a list of TANs top 10 holdings. There may be some opportunity to hop in an enjoy some gains in this sector in the months ahead.

3/23/2019

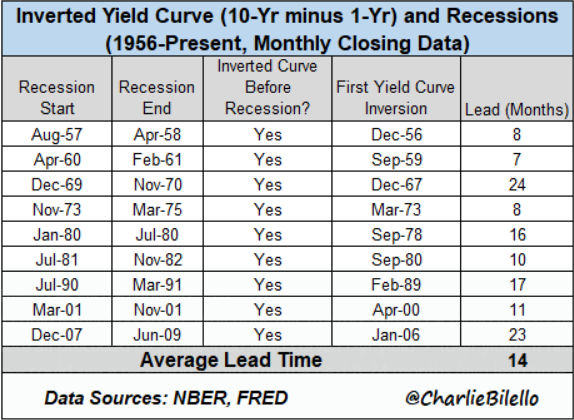

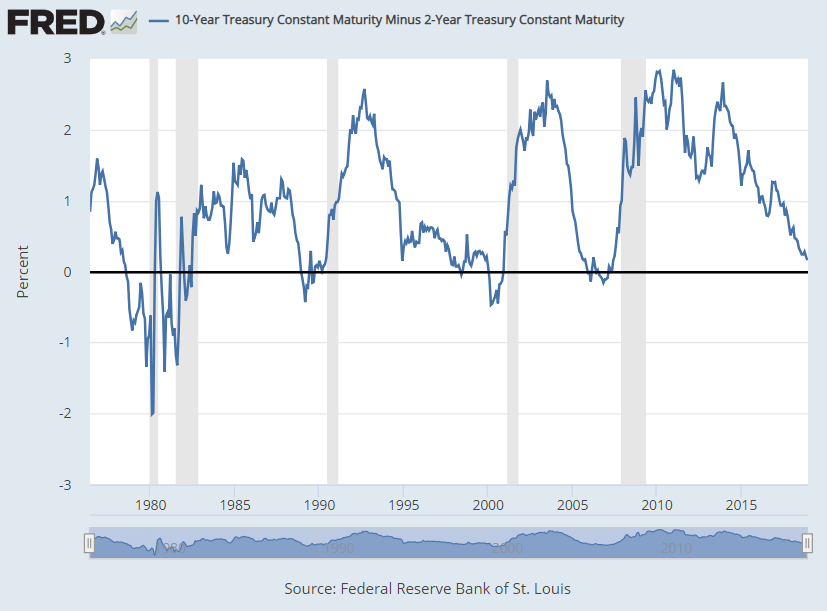

For the first time since 2007 the treasury yield curve has inverted. This is one the most accurate indicators of a future recession. In my opinion this will set the markets up for a recession in 2020. This week the Federal Reserve met and announced there may be only one more rate hike in 2019. At the first sign of a market slowdown the Fed will probably begin to cut future rates.

3/17/2019

Iqiyi Inc (IQ) is the Netflix of China. Since the beginning of January this stock has continued to march higher. Good earnings at the end of February blasted IQ over $29.00 per share. Since then a lot of consolidation has taken place and it is looking like IQ is ready to run again. This a a relatively new stock. It’s IPO took place last March. If you would have taken $10,000 ten years ago and bought Netflix it would be worth over $600,000 today.

2/24/2019

The Chinese stock market has had some significant gains for the past month. Notice this market is rising on increasing volume and that is a very good thing to see. ASHR tested its old bottom and began to break out. China has its share of debt problems, but I think it has plenty of room to run. If some type of trade deal between the US/China it will send Chinese market soaring.

2/10/2019

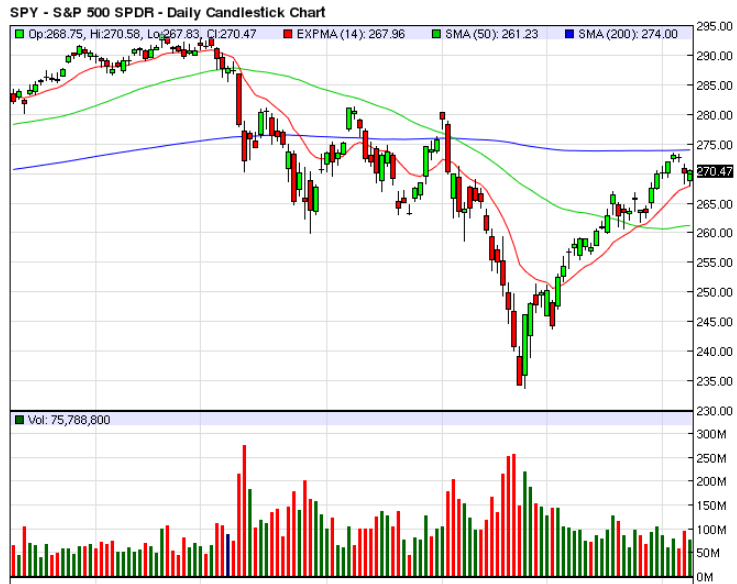

After coming out of treacherous December, the month of January was completely the opposite. The rally last month was the best market performance in January in 30 years. I expect 2019 to be a great year for the overall market. One thing I find a little concerning at present time is the lack of volume in the market run up. Last week the S&P moved back to its 200 day moving average but failed to break through. There may be a bit of a sideways grind ahead but once S&P breaks above that level, the overall volume should rise. A lot of market algorithms will not buy stocks trading below the 200 SMA. They will enter the market once the uptrend breaks through the 200 day moving average.

1/6/2018

Last week Altria Group Inc (MO) was the trade of the week and it closed up 3%. AOBC and WMT also closed higher for the week. The big gainer was LABU, the biotech 3X Bull. It gained over 21% from it previous Friday Close. It stared the week at $30.50 and by Friday it was pricing at $37.01. I believe the overall market is headed higher. Technology and bio-tech stocks are going to lead the way. Health care and consumer discretionary should also to well in the first quarter of 2019.

12/18/2018

With the Dow Jones down over 10% from its peak, investors may be getting weary this bull market has ended. I am of the opposite opinion and consider myself a bearish investor. There is still room to run in the overall market. One of the most helpful tools to look at when predicting the next recession or a market downturn would be the Feds 10 year treasury bond minus the 2 year treasury bond. When the 2 year bond has a higher rate of return than the 10 year, a recession sets in 6 months to 2 years later. Part of the yield curve is is already inverted. Currently the 3 year bond is trading higher than the 5 year bond. I believe tax cuts are still working their way through the system and more stock buy backs are in store. It’s not the healthiest or ethical way to make money but that is what will happen going forward. With the Fed funds rate over 2% they can now cut rates and even unleash QE4 to keep this market afloat.

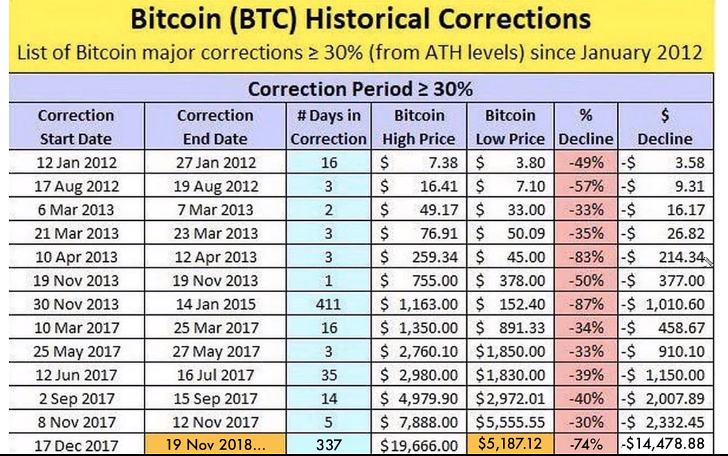

11/29/2018

A few days ago Trace Mayer posted a chart of the previous declines Bitcoin has experienced since its inception. At current time this selloff looks horrific on a a chart. To keep it in perspective BTC suffered an 83% correction in April of 2013 and an 87% correction in January of 2015. The average decline in the previous twelve down markets has averaged 74%. Now may be a time where an investor might want to speculate with less than 5% of their invest able income. I believe this market will base and run again. The next time wall street will be leading the charge instead of watching from the sideline.

11/4/2018

At the end of the day on Monday, I noticed TQQQ looked oversold. It hit $44 and and moved quickly back towards $47 by the end of the day. Before the close I took a position at $46.95. On Tuesday it blasted a higher and continued to move up on Wednesday morning. After reaching the $53.35 area , it began to lose steam and I took a 13% profit at $53.08. Not bad for holding a stock for 2 days. It did reach as high as $54.93 but closed the week at $52.05. With the mid-term elections on Tuesday volatility is going to be certain. If the market moves down I am going to watch and see if TQQQ can hold between $45-$46.

10/25/2018

We are two weeks into this October correction and the S&P 500 etf (SPY) is down 10%. This sell off looks alot like the one we went through in February. The pain might not be over yet but I am not giving up on the overall market trend. Last night a webinar was put on by the guys at Stansberry Research. This pullback has them excited and they are looking to capitalize on future gains. Their data points to no signs of a market top. They were very excited about the tech market moving forward. It may pay to wait for a little strength and then get it. Below is a video done by Jason Leavitt on the current state of the market.

10/10/2018

A big plunge in the market doesn’t have me too concerned. As long as the SPY stays close to its 200 day moving average as it has done in previous corrections, this market should base and continue its upward trend. The saying goes a bull market takes the stairs up and the elevator down. An 832 point drop is defiantly taking the elevator down. That being said, if there continues to be multiple down days on large volume it may be the end of the bull run.

10/4/2018

Intelsat (I) continues it breakout. This was listed as my trade of the week on 9/9/2018 at $21.93 share. How high is this stock going to run? If it closes up today, that would make 8 consecutive positive days.

9/20/2018

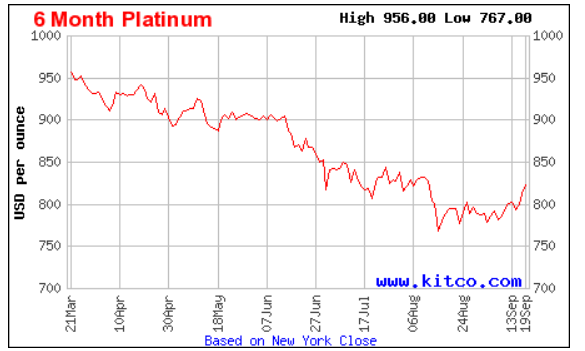

Platinum hit $1,014 in January and then steadily declined in price for the past nine months. It August it hit its bottom of $767. A couple a weeks ago it looks like it is finally beginning to break out. South Africa is one of the largest producers of platinum and there is a lot of political uncertainty in that region. Platinum is much rarer that gold but it is pricing $375 less per ounce.

9/15/2018

Intelsat S.A. (I) was last weeks trade of the week. In five days of trading Intelsat gained 6%. At the beginning of September this stock touched its 50 day moving average for the first time since April. Often times the best way to enter a stock that is breaking out is to wait for a pullback to its 50 day. The same thing happened with ETSY around $29.

9/10/2018

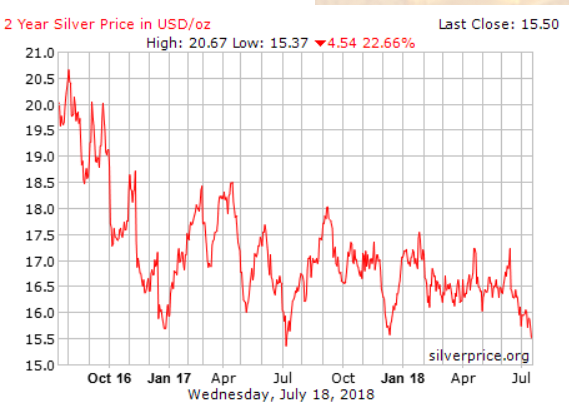

Last week the gold to silver ratio hit 85:1. That is the largest spread between the two metals since the begging of 2016. There is talk JP Morgan has covered its short position on the commitment of traders report. The precious metals and commodities in general have been in a downtrend for many years. The strong dollar has been pushing prices down in recent months. These markets are cyclical and will come back.

9/2/2018

On the day Donald Trump was elected American Outdoor Brands Company (AOBC) lost over 25%. From that time, this stock continued in a downward spiral. In April and May of this year AOBC started to breakout before testing its previous bottom in August. Last week it began to rise and on Friday massive volume entered the market. This looks like the beginning of a new uptrend for AOBC.

8/28/2018

The chart below breaks down debt from four different age categories. Older millennials on ages 25-34 on average carry the most debt. This study showed they hold and average of $42,000 of debt. That excludes their mortgage debt. I was surprised the baby boomers have as much debt as they do.

8/21/2018

CRON was the trade of the week on July 29th. It was trading at $6.23 and sitting right on its 200 day moving average. For a couple of weeks it fell and stabalized around $5.60. On Wednesday last week it began to break out and today CRON almost reached $9.00 before closing at $8.29. Big volume showed up this week.

8/19/2018

The headline below was from CNBC on Wednesday July 11, 2018. This is why a I believe having some exposure to precious metals and crypto currencies is not a bad hedge. Owning assets outside the financial system makes a lot of sense. This number will continue to rise in the years ahead. One day there will be a leveling up.

8/16/2018

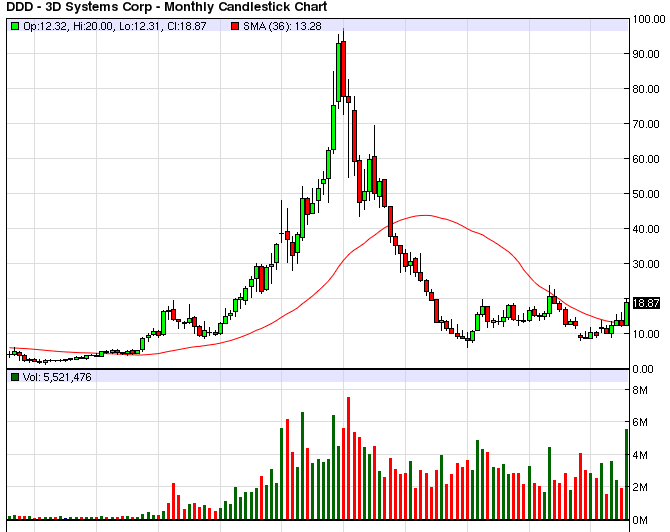

I took a snapshot of a couple of 3D stocks on a 10 year chart last night. Since 2014 DDD has crashed and trended sideways. This month big volume entered this stock. A chart of SSYS looks the same. DDD moved up 10 fold from 2012 to 2014. Defiantly an industry to keep an eye on. 3D printing will have its day in the sun again.

8/14/2018

To check the price of all the crypto currencies I go to www.coinmarketcap.com I checked on the prices to tonight and see the total market cap for all the currencies is 195 billion dollars. When Bitcoin was priced near $20,000 the total market cap was well over 800 billion dollars. At current time BTC makes up 54% of the entire market. I have not seen prices this depressed in some time. The institutional money has got to be looking for an entry. When that money starts flowing in it is going to be easy to spot with prices rising quickly. Litcecoin got down to $50 and Cardono reached $0.09. This is a very ravaged market.

8/12/2018

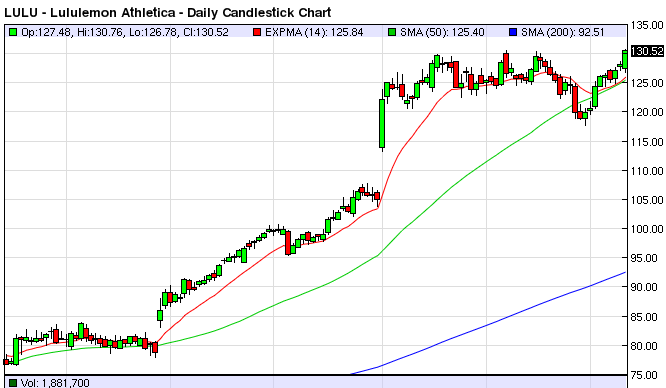

Lululemon Athletica (LULU) was last weeks trade of the week. It broke out the way I thought it would closing the week up 3.5% It has nor broken resistance at $130 and may continue to run. Ichor Holdings (ICHR) was on the stocks to watch list at it gained over 9% by Wednesday before closing the week up 3.5%.

8/10/2018

Etsy has been on fire in 2018. At the end of May it was my trade of the week when it touched its 50 day moving average and began to break out. With over 44 million people in the United States taking on some type of side hussle, Etsy is a perfect fit for someone with an artistic ability. Its very low risk and can make you a lot of money with the right niche. Large volume continues to pour in.

8/7/2018

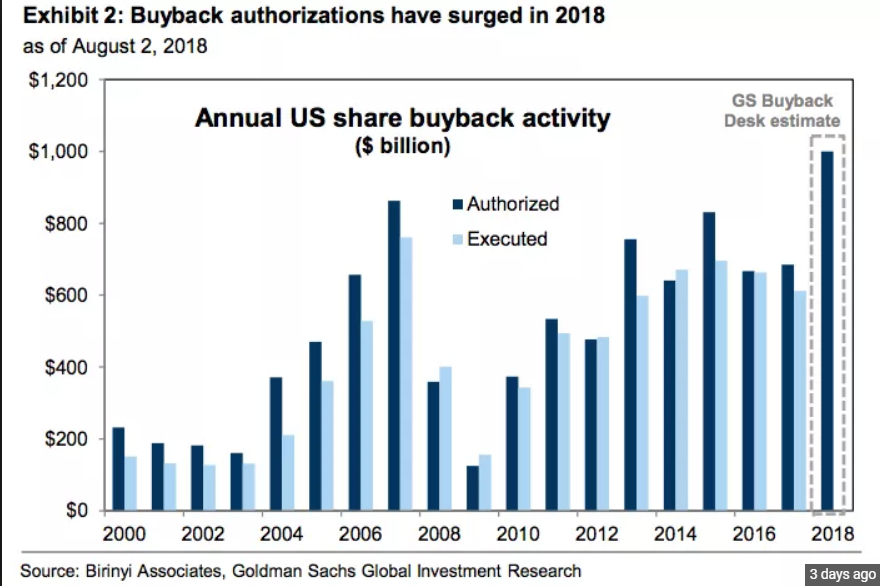

Goldman Sachs is forecasting over 1 trillion dollars in stock buy backs for 2018. Not too surprising with amount of tax cuts most of these companies were given. Until 1982 it was illegal for a company to buy back it's own stock. The fear was they would manipulate there stock price and the average stock purchaser wouldn't have a way to access its value.

8/4/2018

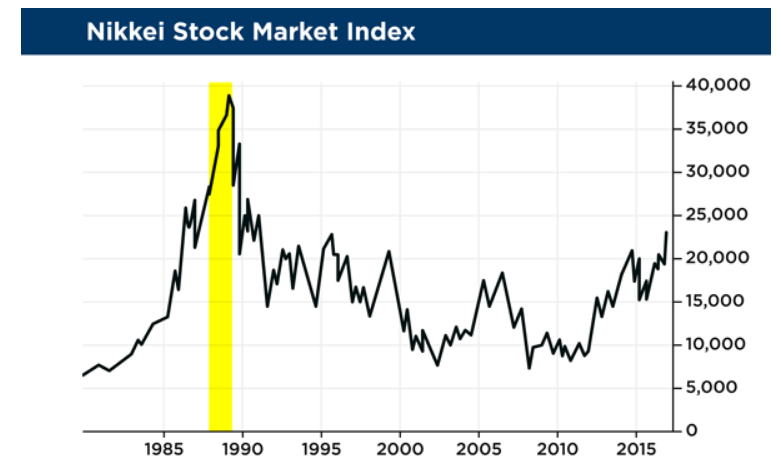

On Friday I became a member of Steve Sjuggarud's True Wealth Newsletter. I have followed the market extremely close for the past decade and his forecasts have been very accurate. Spending a few dollars on a subscription now could pay off nicely in the future. The chart below is the Japanese Nikkei Stock Market when it rose dramatically in the late 1980's. His melt up thesis for the US markets is something everyone should be aware of. http://dailywealth.com/articles/the-melt-up-is-officially-underway-3/

8/3/2018

I have been a member of Follow the Money for the past 4 years. I flew out to the 2016 Summit in Colorado and recently attended the 2018 event in Arkansas. For the month of August you can become a gold member for only $1. It will be the best dollar you spent all year. Below is a picture with Jerry Robinson, the founder/CEO of Follow the Money. For more details check out this link. Follow the Money $1 Membership

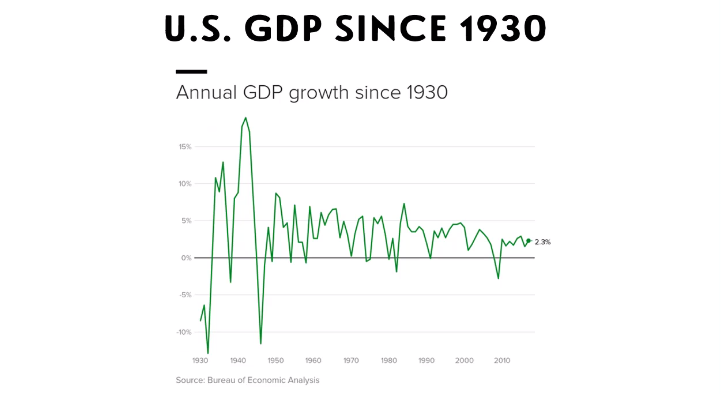

7/31/2018

GDP was released last week and the number came in at 4.1%. It was a good number overall. It did get a little boost from exports from countries making purchases before the tariffs begin. The chart below shows GDP starting in 1930 and going through today.

7/28/2018

Noah Holdings LTD. (NOAH) did well as the trade of the week. It gained 6.4% from the open on Monday to the close on Friday. NOAH was one of the many Chinese stocks that bounced back this week.

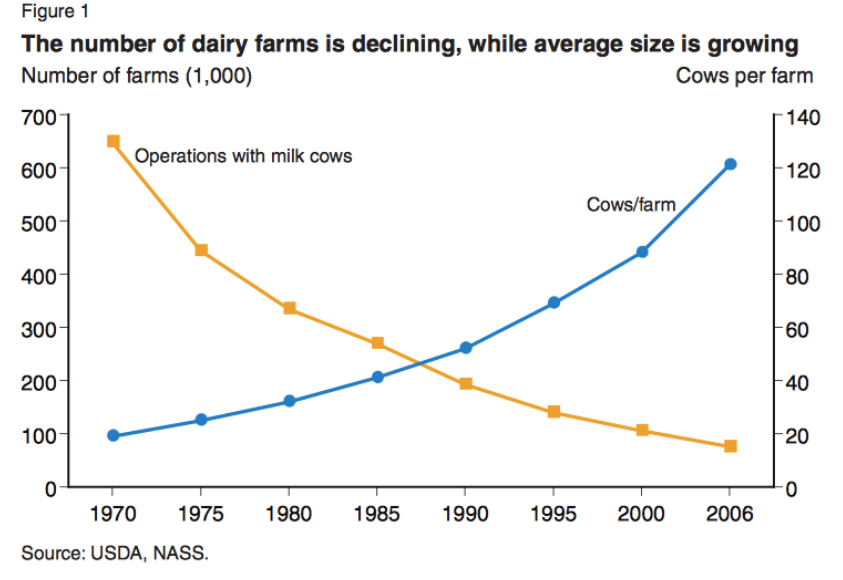

7/26/2018

I posted an article about the farms in America declining to less than 40,000. Below is a chart that shows how many farms there are in the US and the average amount of cattle on them since 1970. In a little less than 50 years the United States has gone from 650,000 farms to less than 40,000.

7/24/2018

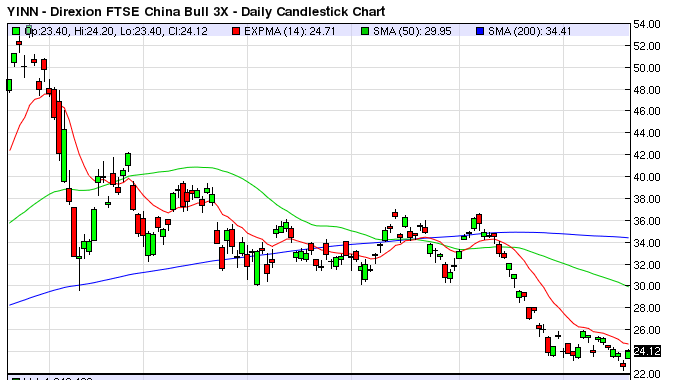

YINN the Chinese 3X ETF had a big day today. This stock closed up almost 10% today after moving up on Friday last week. Today big volume drove this stock up by trading 3.2M shares, more than triple its normal volume.

7/23/2018

Tenet Healthcare Corp. (THC) was my trade of the week two weeks ago. It finally broke out on big volume after 3 weeks of consolidation. The health care sector started to move higher in the middle of May and has trended higher since. I circled the candle stick where I thought a potential good entry would be.

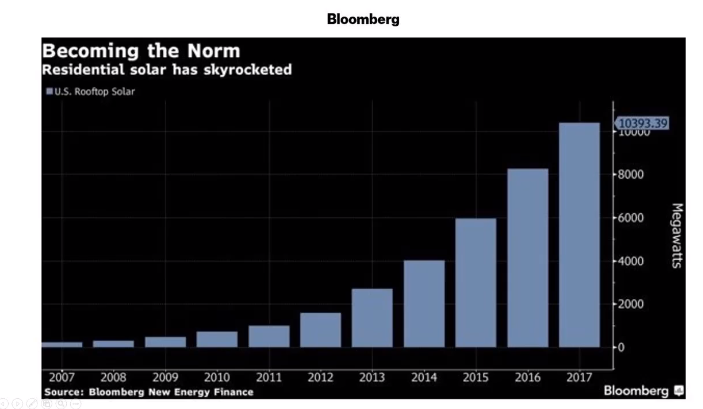

7/22/2018

Look at the current trend of solar. On new residential construction in California, it will be mandatory to have it equipped with solar energy. What are they going to build the solar cells with? Silver would be my guess since it is pricing under $16/oz. Solar and silver are poised to be winners in the future.

7/21/2018

The Chinese market 3X etf surged over 6% yesterday. This ticker is down over 50% from its January highs. The tariff spat with China is just a bump in the road. I think in the years ahead there is a lot of upside for China. If a 3X stock doesn't suit your strategy, ticker FXI or ASHR maybe a better way to gain access to that market.

7/19/2018

I woke up this morning too find the spot price of silver priced at $15.24. This is lowest price in well over 2 years. It's very comparable to what happened in July of 2017. A monster box from APMEX is pricing at $8,920. Very cheap

7/18/2018

Personal savings rates continue to decrease to levels seen in 2007. I find it suspect the media has been reporting about all the money tied up in real estate. It's almost like they want you to borrow against it just like they did a little over 10 years ago.

Market Thoughts

5/20/2018

California is now making it mandatory that newly built homes must have solar panels on them. https://www.cnbc.com/2018/05/09/california-approves-plan-to-mandate-solar-panels-on-new-homes.html

Australia is now banning cash transactions over $10,000. https://www.theguardian.com/australia-news/2018/may/08/australia-federal-budget-2018-cash-payment-crackdown-tax-evasion

Facebook is looking to add a block chain division. https://www.reuters.com/article/us-facebook-moves/facebook-shakes-up-management-launches-blockchain-division-idUSKBN1IA05S

Silver is almost to the end of its pennant formation which, which was is it going to break. https://www.youtube.com/watch?v=DfrCLzRmZ3M

The Gemini exchange added Litecoin to its platform. https://www.forbes.com/sites/michaeldelcastillo/2018/05/14/winklevoss-brothers-bitcoin-exchange-adds-zcash/#4c6b45a36b98

A great article put out by sovereign man about the retirement crisis at hand. https://www.sovereignman.com/trends/americas-long-term-challenge-2-the-looming-retirement-crisis-23432/

Aurora is buying out MedReleaf for $2.5 billion dollars. The marijuana market looks like it is starting to move. https://www.reuters.com/article/us-medreleaf-m-a-aurora-cannabis/aurora-to-buy-medreleaf-for-2-5-billion-in-biggest-ever-pot-deal-idUSKCN1IF16U

REMX was the trade of the week and it stayed in consolidation mode. It closed the week down 7/10 of 1%. That is one to keep on the radar going forward. BGFV gained a half of 1%. MDR closed the week up 3.5%. The big winner was AEO closing last week up 12%.

5/13/2018

If you live in Wisconsin be sure and take advantage of the one-time child tax credit. For each child under the age of 18 on December 31, 2017 you will receive $100. The application period is from May 15, 2018 through July 2, 2018. https://childtaxrebate.wi.gov/

Q1 Earnings were the best in seven years. https://www.cnbc.com/2018/04/12/first-quarter-corporate-profits-surged-16-percent-the-most-since-2011.html

The federal government collected record taxes through April. https://www.cnsnews.com/news/article/terence-p-jeffrey/feds-collect-record-taxes-through-april-still-run-3854b-deficit

Buffett bought more Apple stock. https://www.fool.com/investing/2018/05/10/why-warren-buffett-bought-more-apple-stock.aspx

Wells Fargo fined 1 billion dollars. https://www.npr.org/sections/thetwo-way/2018/04/20/604279604/wells-fargo-hit-with-1-billion-in-fines-over-consumer-abuses

Crypto currencies hit on South Korean raids. https://www.marketwatch.com/story/why-a-raid-in-a-south-korean-crypto-exchange-rattled-the-wider-bitcoin-market-2018-05-11

This was a great week for the stocks on my watch list. Tencent Holding (TCEHY) was the trade of the week and it gained 5.5%. ZG was up over 2%, ENB gained 7%, and GLOB was the largest gainer closing the week up 12.6%. At one point on Friday GLOB was up 21%.

5/6/2018

The ECB will be leaving interest rates at zero. https://www.forbes.com/sites/jjkinahan/2018/05/02/fed-leaves-rates-unchanged-and-sees-inflation-nearing-its-target-but-in-check/#5aec352960e0

The Feds 2% inflation target has been hit. https://www.marketwatch.com/story/inflation-hits-feds-2-target-possible-prelude-to-faster-rise-in-us-interest-rates-2018-04-30

Record government borrowing in the first quarter. http://www.foxnews.com/us/2018/04/30/us-treasury-says-q1-borrowing-set-record-488-billion.html

The second richest man in Egypt put 3 billion dollars into gold. https://coinweek.com/bullion-report/egyptian-billionaire-one-of-forbes-richest-in-world-invests-almost-3-billion-in-gold/

Last week the trade of the week FAST closed down just under 1%. On the stocks to watch list, OCLR was the best performing stock closing the week up 3%.

4/29/2018

The phrase silver tsunami will be used frequently in the future. https://www.sfchronicle.com/opinion/article/Silver-Tsunami-hits-as-pension-costs-devour-12851975.php

The 10 year treasury broke above 3% last week. https://www.cnbc.com/2018/04/25/the-10-year-treasury-yield-has-hit-the-3-percent-level--heres-what-that-means.html

Mish Shedlock put out a great piece on home buying. https://www.themaven.net/mishtalk/economics/home-buyer-s-dilemma-explained-in-one-picture-aBWUSNhFQEGcplq8E8PDUg/

Ethereum is joining up with Amazon. https://www.newsbtc.com/2018/04/24/amazon-reveals-blockchain-templates-for-ethereum-and-hyperledger-fabric/

Deutsche Bank reported terrible earnings. https://www.cnbc.com/2018/04/26/deutsche-bank-earnings-q1-2018.html

SQ got hit hard on Monday and Tuesday and recovered a bit by the end of the week. It closed down 8% for the week. SNV was the top gainer, adding 5%.

4/22/2018

There was a major rare earth discovery was unearthed in Japan. https://www.cnbc.com/2018/04/12/japan-rare-earths-huge-deposit-of-metals-found-in-pacific.html

The seven and ten year bond yields are getting very close to one another, David Stockman sees a yield shock coming. https://www.marketwatch.com/story/mother-of-all-yield-shocks-is-about-to-crush-stocks-warns-father-of-reaganomics-2018-03-21

Silver srcap metal inventories hit a twenty eight year lows. https://srsroccoreport.com/global-silver-scrap-supply-falls-to-26-year-low/

Retail bankruptcies are expected to be at record highs in 2018, despite the Dow trading over 25,000. https://www.cnbc.com/2018/04/18/the-amount-of-retail-space-closing-in-2018-is-on-pace-to-break-record.html

The trade of the week and the others on the watch list did well last week. KMG closed the week up 3%, ARJD gained 1%, GLUU added 8%, while TRX was the big winner increasing just over 10%.

4/15/2018

Jeff Gunlach made remarks a gold rally may not be far away with a weakening dollar and exploding deficits. http://www.kitco.com/news/2018-04-11/Are-Gold-Prices-Ready-To-Break-Out-Bond-King-Jeff-Gundlach-Thinks-So.html

The EIA expects gas prices to be 11% higher than they were in the summer of 2017. https://www.eia.gov/petroleum/weekly/

Wells Fargo reported mortgage originations were down 10 billion dollars. The second lowest numbers since the financial crisis. https://www.zerohedge.com/news/2018-04-13/wells-just-reported-worst-mortgage-number-financial-crisis

The 10 year treasury auction held last week was the worst in eighteen months. Declining interest from foreign central banks was the cause of the low bidding. https://www.reuters.com/article/usa-auction-10year/indirect-bidders-u-s-10-year-note-purchase-hits-1-1-2-years-low-idUSL1N1RO1B4

Dineequity (DIN) closed the week up just $0.25. On Thursday VCEL was up almost 18% before closing the week just up 3%. The best gainer of the week was Alcoa (AA), it made gains of 12%.

4/8/2018

128 tariffs went into effect on US agriculture products. http://fortune.com/2018/04/02/china-tariffs-128-us-products/

Q1 on 2018 was the second worst quarter since the Great Depression. https://www.bloomberg.com/news/articles/2018-04-02/stocks-second-quarter-start-is-worst-since-great-depression

The Chicago Merchantile Exchange set record for metals trading volume in Q1 http://investor.cmegroup.com/investor-relations/releasedetail.cfm?ReleaseID=159127

George Soros is getting ready to enter the crypto arena. https://www.bloomberg.com/news/articles/2018-04-06/george-soros-prepares-to-trade-cryptocurrencies-as-prices-plunge

Powell remarks moved the Dow Jones down 700 points. https://www.morningstar.com/news/market-watch/TDJNMW_20180406626/update-dow-drops-over-700-points-stocks-extend-selloff.html

3/25/2018

As expected the Federal Reserve moved rates up again. https://www.cnbc.com/2018/03/23/4-things-to-do-with-your-money-when-the-fed-raises-rates.html

The tariff war between the US and China is heating up. https://www.cnbc.com/2018/03/23/trumps-tariffs-trade-war-will-be-bad-for-us-and-china-cnbc-survey.html

The Bank of England held rates steady but indicate they will rise in the future. https://www.theguardian.com/business/2018/mar/22/uk-interest-rates-bank-of-england-pound-monetary-policy-committee

On Monday oil will now be traded in Chinese Yuan. https://www.barrons.com/articles/china-seeks-greater-role-in-global-oil-trade-1521852463

Simon Black released an interesting article about the future of pensions in America. https://www.sovereignman.com/trends/congress-quietly-formed-a-committee-to-bail-out-200-pension-funds-23169/

American Water Works (AWK) closed the week down 4%. The 1400 point selloff in the overall market brought this stock with it. HP was the big gainer closing up almost 7%.

3/18/2018

Loyd Blankfein is being replaced by David Soloman at Goldman Sachs. https://economictimes.indiatimes.com/news/international/business/goldman-sachs-names-david-solomon-as-next-in-line-to-replace-ceo-lloyd-blankfein/articleshow/63271833.cms

Icon 3D Homes can build a 600 to 800 sq foot home for $4,000 https://www.industryleadersmagazine.com/icon-builds-incredibly-cheap-3d-printed-homes-in-less-than-24-hours/

Toy R Us and Baby’s R Us are shutting all their stores. https://www.cnbc.com/2018/03/15/toys-r-us-is-closing-all-of-its-us-stores-heres-where-they-are.html

Wyoming voted to stop taxing silver and gold. https://www.moneymetals.com/news/2018/03/14/wyoming-ends-all-taxation-on-gold-silver-001433

Automotive interest rates are an a eight year high at 5.20%. http://www.thedrive.com/news/19010/interest-rates-on-auto-loans-highest-in-eight-years

Chevron (CVX) was the trade of the week and it finished down just under 2%. WING closed the week up 1%.

3/11/2018

According to the IEA the US will be the largest oil producer by 2023 https://www.wsj.com/articles/u-s-will-be-the-worlds-largest-oil-producer-by-2023-says-iea-1520236810

Half of Americans have less than $10,000 set aside for retirement. https://www.cnbc.com/2018/03/06/42-percent-of-americans-are-at-risk-of-retiring-broke.html

Paypal has a patent pending to provide faster transactions which could be of interest to Visa. https://discover.coinsquare.io/digital-currency/paypal-patent-expedited-digital-currency-payments/

President Xi Jinping of China has now declared himself president for life. http://www.bbc.com/news/world-asia-china-43361276

Gary Cohn left his role as the economic advisor to the President Trump after a dispute over the trade tariffs. https://www.reuters.com/article/us-usa-trump-cohn/after-tariff-fight-loss-trump-economic-adviser-cohn-quits-idUSKCN1GI2ZS

The trade of the week Philip Morris (PM) closed the week up 1%. For a brief moment on Friday it was up almost 3% before selling off. EFX had a great week moving up 7% and Pandora (P) was the big gainers closing up 11%.

3/4/2018

Steel and aluminum tariffs are set to be implemented. https://www.wsj.com/articles/white-house-defends-trumps-proposed-steel-aluminum-tariffs-1520181748

Smart phone sales contracted for the first time in Q4 of 2017 https://which-50.com/smartphone-sales-declined-first-time-q4-2017/

On February 23rd, Steve Wesley, a board member for CAPLPERS, admitted there is a pension crisis looming. https://www.bloomberg.com/news/articles/2018-02-07/california-governor-candidates-dodge-pension-cuts-brown-foresees

Fed tightening has begun according to David Stockman. The Federal Reserve’s plan is to sell 20 B in bonds per month in Q1, 30 Billion in Q2, 40 billion in Q3, and 50 billion in Q4. https://dailyreckoning.com/true-money-supply-predicts-economy/

Jerome Powell hints at four rate hikes in 2018. https://www.marketwatch.com/story/even-as-powell-softens-tone-4-rate-hikes-still-on-the-table-for-2018-2018-03-01

Last week MOMO closed the week down 8% suffering in the overall market selloff. If you are position or long term trader this is one to keep on the radar. BLDR was the top gainer on the stocks to watch list, closing the week up 3%.

2/25/2018

An anonymous trader bought $400 million dollars of bitcoin. https://www.marketwatch.com/story/anonymous-trader-buys-400-million-of-bitcoin-2018-02-16

Litecoin cash has been issued. Current litecoin holders will get 10 litecoin cash for each litecoins they have. https://www.cointelligence.com/content/the-much-talked-about-litecoin-hard-fork-takes-place-to-create-litecoin-cash/

Last week junk bonds saw a major outflow of capital. https://globalinvestorgroup.com/articles/3689537/junk-bond-selloff-spurs-sec-lending-revenues

In the future Apple could buy cobalt directly from the minors instead of out of the open market. Could the same thing happen with other metals like silver? http://www.mining.com/apple-talks-buy-cobalt-directly-miners-report/

Brazil banks began to use ripple to settle transactions starting on February 21st. https://www.ccn.com/brazil-and-latin-americas-largest-bank-will-use-ripple-to-process-payments/

SU the trade of the week closed the week down .09 cents. So essentially a 0% move this week.

2/18/2018

The Chinese Yuan is going to begin trading in the oil markets on March 26, 2018 https://www.bloomberg.com/news/articles/2018-02-09/china-ends-25-year-wait-as-yuan-oil-futures-set-to-start-trading

Arizona passes a law to pay taxes with crypto currencies. http://fortune.com/2018/02/10/arizona-bitcoin-taxes/

Coinbase is going to coming up with a merchant solution to buy merchandise with crypto currency. https://www.newsbtc.com/2018/02/13/coinbase-introduces-paypal-like-merchant-solution-cryptocurrencies/

There is a 83% chance the fed is going to hike rates on March 13th. https://www.liteforex.com/blog/analysts-opinions/dollar-breaks-the-stereotypes/

President Trump unveils infrastructure plans. https://www.reuters.com/article/us-usa-budget-infrastructure/trump-unveils-infrastructure-plan-uphill-battle-awaits-in-congress-idUSKBN1FW1X3

The corporate buy backs were ramping up at Goldman Sachs last week. 4.5 times the normal amount of buybacks were taking place last week. https://www.bloomberg.com/news/articles/2018-02-14/goldman-s-buyback-desk-was-deluged-with-orders-as-stocks-plunged

Buffett is buying a lot of Apple stock. http://www.foxbusiness.com/markets/2018/02/16/warren-buffett-just-bought-loads-apple-stock-should.html

Dollar General (DG) was the trade of the week and closed down less than 1%. The other four set ups did well. BBY and LITE were up 3%, TGT gained 4% last week, and TECK closed last week up 7%.

2/11/2018

The Dow Jones had a record selloff day on Monday. https://www.cnbc.com/2018/02/04/us-stocks-interest-rates-futures.html

The fear around crypto currencies continues as Goldman Sachs put an article out claiming it will go to zero. https://www.bloomberg.com/news/articles/2018-02-07/get-ready-for-most-cryptocurrencies-to-hit-zero-goldman-says

A Goldman Sachs letter to investors indicated they are bullish on gold. They see $1450 in 12 months. http://www.forexlive.com/news/!/goldman-sachs-boosts-gold-price-forecast-sees-1450oz-in-12-months-20180208

The US dollar is off to its wort start since 1987. https://www.fool.com/investing/2017/02/03/this-is-the-worst-start-to-a-new-year-for-the-doll.aspx

XIV the ticker does well under little volatility went from $100 down to $6. One trader lost 4 million dollars. https://www.marketwatch.com/story/xiv-trader-ive-lost-4-million-3-years-of-work-and-other-peoples-money-2018-02-06

Here is an excellent video showing the US market is not anywhere near a top done by the Leavitt brothers. https://www.youtube.com/watch?v=pfZjELl0riw

DUST, the trade of the week, broke out in a big way. The dollar gained some ground and moved commodity prices like gold down. DUST closed the week up 22%. This is the biggest gainer ever for the trade of the week and it occurred when the market had its worst week in some time.

2/4/2018

US Savings rate at a 10 year low. https://www.marketwatch.com/story/why-the-savings-rate-falling-to-a-12-year-low-is-not-a-death-knell-for-the-us-economy-2018-01-29

Coincheck is refunding customers after the 534 million dollar hack. http://www.independent.co.uk/news/business/news/bitcoin-latest-updates-coincheck-hack-crytocurrency-refund-stolen-money-japan-a8182971.html

Starbucks is looking into accepting crypto currency as payment. https://www.marketwatch.com/story/a-trusted-digital-currency-is-coming-but-its-not-bitcoin-says-starbucks-howard-schultz-2018-01-29

10 year treasury notes spike. https://www.reuters.com/article/us-global-markets/global-stocks-plunge-as-u-s-jobs-data-spikes-bond-yields-idUSKBN1FM02A

Stockton, CA not experimenting with universal income after coming out of bankruptcy. http://reason.com/blog/2018/02/02/stocktons-basic-income-plan-diverts-new

Jerome Powell is ready to take over as the head of the Federal Reserve. http://money.cnn.com/2018/01/31/news/economy/federal-reserve-powell-leadership/index.html

Even with the massive selloff, AT&T (T) the tradeoff of the week closed in positive territory. It gained just over 2.5%.

1/28/2018

The government shutdown was short lived opening back up on Monday of last week. https://www.reuters.com/article/us-usa-shutdown-workers/u-s-government-goes-back-to-work-after-lunch-break-shutdown-idUSKBN1FB0EU

A select few cryptocurrencies can now be put in your IRA. https://www.financemagnates.com/cryptocurrency/news/ira-bitcoin-allowing-approved-crypto-exposure-retirement-funds/

The Robin hood trading platform has now introduced cryptocurrencies. http://fortune.com/2018/01/25/bitcoin-millennials-robinhood-cryptocurrency/

The LME zinc warehouse is now at record low inventories. https://www.reuters.com/article/global-metals/metals-zinc-at-decade-high-as-inventories-trend-lower-idUSL4N1PL3D5

In 2017 the Russian National Bank bought 223 tons of gold and no US treasuries. https://thedailycoin.org/2018/01/22/russia-overtake-chinas-gold-holdings-january-2018/

Planet Fitness (PLNT) was last week’s trade of the week. It closed the week up 5%. EAT managed to gain 1% and MEOH finished the week up just under 4%.

1/21/2018

The government shutdown has begun. http://www.businessinsider.com/what-happens-in-government-shutdown-2018-1

Jeff Gundlach said a 10 year treasury note price below 2.63 will send the market into correction mode. https://latest-today-news.com/2018/01/19/10y-treasury-crosses-gundlachs-red-line-will-stocks-start-to-suffer/

The monthly RSI is the highest it has been in 100 years. https://www.milesfranklin.com/an-important-time-of-year/

Future fed chair has publicly acknowledged the Fed has to unwind its short position in the volatility index. https://www.zerohedge.com/news/2018-01-05/fed-chair-makes-striking-admission-we-have-short-volatility-position

Alibaba launched its trading platform for block chain. https://www.coinspeaker.com/2018/01/16/blockchain-based-job-platform-blocklancer-launches-ico-today/

Central banks were the largest buyers of gold in 2017. http://goldaboutinvestment.com/2018/01/central-banks-are-the-new-gold-bugs.html

Last week all six stock ideas closed in positive territory. IRBT, the trade of the week closed up 1.8% for the week. GRMN gained 3%, LVS gained almost 5%, and WYNN was the biggest mover closing the week up 8.5%.

1/14/2018

Peter Thiel has taken a large position in bitcoin. http://www.businessinsider.com/peter-thiels-founders-fund-invested-big-in-bitcoin-2018-1

Jamie Diamon regrets calling bitcoin a fraud. http://www.businessinsider.com/peter-thiels-founders-fund-invested-big-in-bitcoin-2018-1

The Chinese inferred they may begin to pull back their purchasing of US Bonds which could jeopardize the thirty year run in bonds. https://www.cnbc.com/2018/01/10/reports-on-china-slowing-us-debt-buying-could-be-based-on-wrong-information-source-says.html

At a Ripple Conference, Ben Bernanke called Ripple a currency of the future. https://www.profitconfidential.com/cryptocurrency/ripple/ripple-price-forecast-xrp-poised-gains-ben-bernankes-comments/

Last week EA was the trade of the week it mostly consolidated before it broke out on Friday to close the week up 1%. BITA was up almost 4% before rolling over and closing negative for the week. IGT was up 3% and LVS finished the week up a little over 4%.

1/7/2018

In the first quarter of 2018 Mexico is on track to legalize medical marijuana. https://cannabis.net/blog/news/mexico-medical-marijuana-framework-update-2018

The International Energy Exchange is scheduled to start trading oil on January 18, 2018. The state council gave it approval in December. https://www.washingtonpost.com/business/how-china-will-shake-up-the-oil-futures-market-quicktake-qanda/2018/01/01/9cc74654-ef73-11e7-95e3-eff284e71c8d_story.html?utm_term=.976b065264c5

There is a bill in congress that would allow those with large student loan debt to collect their social security right away to pay it down. In return they would have to wait until the age of 73 start collecting social security in retirement. https://www.fool.com/retirement/2018/01/03/would-you-trade-your-social-security-for-student-l.aspx

Russia is looking to create their own national currency with block chain technology. https://www.ccn.com/putin-orders-work-cryptoruble-escape-western-sanctions/

TILE closed the week down five cents at $25.10. I would call that a push. NGD closed the week up 4%, while MTL finished up 3%.

1/1/2018

Ripple past Ethereum to become the second largest crypto by market cap. https://www.cnbc.com/2017/12/29/ripple-soars-becomes-second-biggest-cryptocurrency-by-market-cap.html

Recreational marijuana is now legal in California. It sent stocks in that sector much higher. http://www.businessinsider.com/recreational-marijuana-legal-in-california-2017-12

Subprime auto defaults are increasing at a rapid pace. https://www.snip.today/post/subprime-auto-loan-investors-want-out-as-defaults-are-on-the-rise/

NRG was the trade of the week and it closed up 1%. CWT was up 3%, SWN gained 4.8%, and UNG was the big winner closing the week up 11%

12/24/2017

Large banks have reduced their short positions in silver. This is one of the largest reductions in history. Often times this leads to an price increase for silver. http://www.zerohedge.com/news/2017-12-12/buy-gold-silver-time-after-speculators-reduce-longs-and-banks-reduce-shorts

Litecoin founder, Charlie Lee, liquidated all of his litecoins to remove an speculations around him making public statements where he could be pumping up the price. http://www.businessinsider.com/litecoin-creator-charlie-lee-sells-entire-ltc-holding-2017-12

Wal-Mart is now allowing its employee to access their check before they are issued. https://www.bloomberg.com/news/articles/2017-12-13/wal-mart-to-allow-workers-early-access-to-pay-via-fintech-accord

Mike Maloney released Hidden Secrets of Money, episode 8. https://www.youtube.com/watch?v=SF362xxcfdk

Fed Governor Neil Kashkari issued a statement at the last fed meeting indicating he see the yield curve flattening out in 2018. https://www.bloomberg.com/news/articles/2017-12-18/fed-s-kashkari-says-flatter-yield-curve-helped-motivate-dissent

Berkshire Hathaway A shares closed above $3,000 for the first time. https://www.cnbc.com/2017/12/18/shares-of-warren-buffetts-berkshire-hathaway-rise-above-300000.html

Intel (INTC) closed the week just under 5%. SOXL closed up 4.7%, and GTLS was up 1%.

12/17/2017

As expected the Federal Reserve raised rates last week. In 2018 there is expected to be three more. https://www.wsj.com/articles/fed-raises-interest-rates-sees-continued-path-of-increases-in-2018-1513191780

New housing starts hit 10 year high. http://www.businessinsider.com/r-us-new-home-sales-race-to-10-year-high-in-october-2017-11

Personal savings rates are in decline. https://mises.org/power-market/personal-saving-falls-lowest-rate-2007

The MSCI index is set to close positive all 12 months for the first time in history. https://www.marketwatch.com/story/global-stocks-could-make-history-this-month-by-refusing-to-fall-2017-12-08

The California Road Charge Pilot Program is going to be tested out. Automobile owners will pay tax per mile driven. http://sanfrancisco.cbslocal.com/2017/12/11/california-considers-mileage-tax/

ESPR was the trade of the week and it closed up just under 2.5%. It was up as much as 7.7% by mid-week. NKE had a nice run closing the week up 5.5%.

12/10/2017

Venezuela is going to have an ICO for the petro, in which the country will have a crypto backed by its oil. https://www.reuters.com/article/us-venezuela-economy/enter-the-petro-venezuela-to-launch-oil-backed-cryptocurrency-idUSKBN1DX0SQ

Buffett made a comment that stated “If the Chinese Government can’t control block chain currencies, no one can. https://www.bing.com/videos/search?q=buffet+on+china+controling+bitcoin&view=detail&mid=10DD91306D17D4ADCD8110DD91306D17D4ADCD81&FORM=VIRE

Coinbase had to temporarily shut down their website because of the vast number of new members joining. https://www.geekchoice.com/2017/12/08/the-bitcoin-craze-drives-apps-popularity/

The Chicago Mercantile Exchange (CME) is going to start trading Bitcoin contracts starting on December 18th of 2017. http://www.cmegroup.com/media-room/press-releases/2017/12/01/cme_group_self-certifiesbitcoinfuturestolaunchdec18.html

Russia declared victory of ISIS in Syria. http://www.foxnews.com/world/2017/12/09/iraq-declares-victory-in-war-against-isis.html

The Fed will meet this coming week and most likely raise the fed funds rate this week. Previous rate hikes have put in the bottom for the precious metals which have been battered the past couple of weeks. http://www.businessinsider.com/fed-december-meeting-focus-is-2018-path-of-rate-hikes-2017-12

ERX closed the week down as the energy market gave a little back. It closed the week down 2%

12/3/2017

Bill Dudley made it publicly known the Fed is currently working on their own block chain currency. https://www.reuters.com/article/us-usa-fed-dudley/amid-bitcoin-surge-dudley-says-offering-digital-currency-on-feds-radar-idUSKBN1DT26J

UBS and Bank of America sent letters to their clients letting them know a market correction could be in store.

John Bogle, the founder of Vanguard, made a public statement to avoid bitcoin like the plague. https://www.bloomberg.com/news/articles/2017-11-28/vanguard-founder-jack-bogle-says-avoid-bitcoin-like-the-plague

Coinbase added 300,000 new users last month. https://www.thestreet.com/story/14403918/1/bitcoin-10000-should-investors-be-concerned.html

Sherrod Brown, a senator from Ohio, put forth a bill where underfunded pensions can borrow from the treasury. http://www.zerohedge.com/news/2017-11-08/it-begins-democratic-senator-introduce-bill-taxpayer-funded-pension-bailouts

Visa (V) moved up early in the week and then begin to struggle on Wednesday. The market selloff on Friday didn’t help, Visa closed the week down 1%. RSO was up 2% on Wednesday but closed the week flat. GNTX did the best closing up over 5.5%.

11/26/2017

According to data from the Investment Company Institute, money is continuing to flow into domestic etfs. Emerging market markets are seeing the biggest amount allocated to their etfs. Money is coming out of commodities. http://www.yardeni.com/pub/icieqbnd.pdf

Overstock.com is one of the first US companies to except crypto currencies as a form of settlement. Since that announcement was made over 4 months ago, OSTK has tripled. It was trading at $18 in August and is over $54 per share today. https://www.zacks.com/stock/news/279115/overstockcom-ostk-stock-is-surging-today-heres-why

A crypto school is has now been launched for those who was to increase their knowledge of the cypto currency market. www.thecryptoschool.io

Ray Dalio increased his position in GLD by 600% http://www.kitco.com/news/2017-11-14/Ray-Dalio-Buys-500-Million-In-Gold-EFTs-In-Q3.html

Tencent now has a bigger market cap than Facebook. https://seekingalpha.com/article/4004742-tencent-bigger-facebook

Mugabe has been replaced as the leader of South Africa. http://www.foxnews.com/world/2017/11/21/figure-known-as-crocodile-set-to-replace-zimbabwes-mugabe.html

TSCO was the trade of the week. It moved up on Monday and Tuesday but closed Friday at 64.29 down about 1/3 of 1%. FIW closed up 2%, NVO closed up over 2% and URA closed the week up 7.5%.

11/19/2017

Keep an eye on Uranium stocks. Cameco and Denison Mines are cutting supply which could boost their stock price. https://www.fool.com/investing/2017/11/09/denison-mines-stock-spikes-after-cameco-announces.aspx

Venezuela has officially defaulted on their debts. https://www.forbes.com/forbes/welcome/?toURL=https://www.forbes.com/sites/francescoppola/2017/11/14/venezuela-defaults/&refURL=https://www.bing.com/&referrer=https://www.bing.com/

Tencent (TCEHY) a Chinese tech giant bought 12% of Snapchat. https://www.reuters.com/article/us-snap-tencent-stake/chinas-tencent-takes-12-percent-stake-in-snap-as-shares-plunge-idUSKBN1D81G3

This week a Da Vinci painting of Christ sold for 450 million dollars. Paper money isn’t losing its value? https://www.nytimes.com/2017/11/15/arts/design/leonardo-da-vinci-salvator-mundi-christies-auction.html

John Williams, head of the San Francisco said they will need a new tool kit to manage the next financial downturn. http://www.ibtimes.com/feds-williams-says-central-banks-need-consider-new-tools-2195059

Last week Ross Stores Inc. (ROST) reported great earnings which moved the stock up just under 10%. YUMC was up 2% and SKX closed up 5% on Friday.

11/12/2017

The brick and mortar meltdown is a look into what is happening in the commercial realty space. https://wolfstreet.com/2017/11/06/plunging-mall-prices-drag-down-commercial-real-estate/

95% of economists believe there will be a fed rate hike in December. http://247wallst.com/economy/2016/11/19/what-to-expect-for-fed-rate-hikes-in-december-and-in-2017/

Margin debt is at an all-time high. http://www.brotherjohnf.com/us-margin-debt-hitting-time-highs-borrowing-speculate-never-popular/

Wall Street is starting to embrace bitcoin. https://www.wsj.com/articles/cme-planning-bitcoin-futures-market-in-big-endorsement-of-digital-currency-1509459517

100,000 new subscribers to coinbase with CME announcement. https://www.bloomberg.com/news/articles/2017-11-02/bitcoin-exchange-added-100-000-users-in-a-day-as-price-exploded

Segwit 2, the next bitcoin fork is not going to occur. https://techcrunch.com/2017/11/08/segwit2x-backers-cancel-plans-for-bitcoin-hard-fork/

LABU closed the week down 10%. 3x stocks cut both ways. The overall market struggled this week. BITA was up over 11% by Wednesday but closed the week in negative territory.

Ross Stores Inc (ROST) has been in a steady uptrend since the end of July and has been in consolidation for the past month. Last week ROST closed positive 4 out 5 days while steadily gaining volume. Earnings are this week so a tight stop loss is must.

Stocks to watch YUMC, SKX, GPOR, and XIN

11/5/2017

Jay Powell is now the new fed chief. He will take his position in February of 2018. https://www.thestreet.com/story/14375157/1/fed-nominee-powell-wants-people-to-be-wealthy.html

Consumer savings rate lowest since September of 2007 https://seekingalpha.com/article/4118931-u-s-savings-rate-lowest-level-since-great-recession

The no money down homes are back in Sacramento. http://www.talkmarkets.com/content/stocks--equities/here-we-go-again-sacramento-sells-425000-pads-with-no-money-down?post=154283

Fed funds rate left unchanged http://www.barrons.com/articles/shocked-shocked-fomc-leaves-rates-unchanged-1509560631

Lst week MYGN was the trade of the week. It closed the week down 18%. The worst in some time. Not all the picks shared that fate. CTRL closed up 10% while SWN finished up 11%. The is a great example of why you trade with a stop loss in place.

10/30/2017

The Dow jones closed at another record high last week. https://www.cnbc.com/2017/10/24/us-stock-futures-earnings-fed-chair-position-tax-reform-on-wall-street-agenda.html

Last week I wrote a new article why I think the market is going to melt up from here. http://www.moneyandtrading.com/articles/

Oil is beginning to breakout. https://www.cnbc.com/2017/10/20/us-is-doing-something-weve-never-seen-before-with-oil-says-kloza.html

The dollar has been moving up for since the end of September. https://www.marketwatch.com/story/dollar-index-jumps-to-3-month-high-as-ecb-fueled-euro-slump-continues-2017-10-27

Last week. Winnebago Industries was the trade of the week. WGO closed up 1%. All the other picks closed the week up as well. AEO was up 2%, GNRC rose 3%, and GPRO closed last week up 5%.

10/22/2017

According to a recent Barron’s article, India’s markets could triple over the next decade. http://www.barrons.com/articles/india-stock-market-could-triple-in-a-decade-1507581236

There are rumors circulating Amazon could accept bitcoin in the future. https://squawker.org/technology/breaking-amazon-will-accept-bitcoin-by-october/

Trump has been holding interviews to determine who the next Fed Chief will be. http://fortune.com/2017/10/19/trump-federal-reserve-chairman-selection/

The dow continues to surge closing at a new all-time high on Friday. https://globalnews.ca/news/3812493/dow-jones-hits-record-high/

The JFK papers are going to be released at the end of October. https://www.washingtonpost.com/local/trump-plans-to-release-of-jfk-assassination-documents-despite-concerns-from-federal-agencies/2017/10/21/d036cf36-b65d-11e7-9e58-e6288544af98_story.html?utm_term=.abf39dc61c51

Consumer sediment at 13 year highs. https://thecheapinvestor.com/2017/10/why-consumer-sentiment-is-at-13-year-highs/

Intrepid Potash Inc (IPI) closed the week down 7% it went back tested its 50 day moving average and broke through to the downside. This is the first trade of the week loss in eight weeks.

10/15/2007

Home mortgage lenders are beginning to ease credit. According to the latest Fannie Mae survey. http://richardselzer.com/2017/10/09/loosening-of-loan-restrictions/

Goldman Sachs is looking to build a platform that trades crypto currencies. https://www.cnbc.com/2017/10/02/goldman-sachs-exploring-bitcoin-trading-operation-report-says.html

Bitcoin makes a run at $6,000 http://fortune.com/2017/10/13/bitcoin-price-japan-6000/

The Saudi Monarch met with Russia to discuss future business. http://www.ibtimes.com/russian-saudi-arabian-officials-meet-st-petersburg-raising-questions-about-possible-1973456

General Electric (GE) is trading at a 52 week low. http://www.nasdaq.com/article/new-52-week-low-could-prompt-more-insider-buying-at-ge-cm788661

The German government has been buying gold. https://lawrieongold.com/2017/10/12/the-germans-now-the-worlds-biggest-gold-buyers/

Last week FNV, the trade of the week closed up 2%. Jet Blue (JBLU) closed up slightly higher finishing the week up 3%. The trade of the week has now closed positive the past seven weeks in a row.

10/8/2017

Catalonia voted to succeed from Spain. The Spanish government will not recognize the vote. https://www.bloomberg.com/news/articles/2017-10-06/european-assets-may-be-resilient-to-catalan-independence-call

JP Morgan was fined 4 billion dollars for mishandling the estate of a former executive from American Airlines. https://www.bloomberg.com/news/articles/2017-09-27/jpmorgan-ordered-to-pay-more-than-4-billion-by-dallas-jury

Atomic swaps have entered the crypto currency business model. Someone can now buy a product with one currency and the seller can get paid in another. https://news.bitcoin.com/altcoin-exchange-performs-first-atomic-swap-between-bitcoin-and-ethereum/

The CFTC wants the financial industry to self-regulate. https://www.nytimes.com/2017/09/24/business/cftc-commodity-futures-trading-commission.html

Last week the first negative jobs number came out. This is the first time in seven years the number was negative. https://finance.yahoo.com/news/jobs-numbers-swing-negative-post-141202103.html

Stocks are at record highs and CNBC has a twenty two year low viewership. http://www.brotherjohnf.com/cnbc-viewership-drops-22-year-low/

Last week all five stock pick closed in positive territory. Coresite Realty Crop (COR) closed up 1%, CRM was up 3%, Z gained 5%, and YINN blasted up 12%.

10/1/2017

S&P gave the Chinese and the UK a downgrade. http://www.marketwatch.com/story/sp-downgrades-chinas-credit-rating-citing-heavy-debt-load-2017-09-21

President Trump released the outline for his new tax brackets. Under the new guidelines there would be three brackets instead of seven. http://www.marketwatch.com/story/sp-downgrades-chinas-credit-rating-citing-heavy-debt-load-2017-09-21

Jamie Diamon’s firm in the UK was the fourth largest buyer of bitcoin the same day he came out and called it a fraud. Funny he would down play block chain currencies since they are a apart of the Ethereum alliance. http://fortune.com/2017/02/28/ethereum-jpmorgan-microsoft-alliance/

NAVI was the trade of the week. At one point is was up over 5%, but closed the week up a little under 2%. CLVS closed up 4.8%, while PVG closed up about 2%.

9/24/2017

The Chinese government made a public statement they will begin to crack down on new ICOs after September 30th of 2017. This statement sent Bitcoin from $5000 all that way down to $3000. http://www.breitbart.com/national-security/2017/09/18/china-cracks-bitcoin-beijing-turns-market-power-strategic-weapon/

Venezuelan President Maduro issued a statement their countries oil will no longer be settled in US dollars. https://www.reuters.com/article/us-venezuela-oil/venezuela-publishes-oil-prices-in-chinese-currency-to-shun-u-s-dollar-idUSKCN1BQ2D1

Toys R Us is going to file bankruptcy. This will be the 2nd largest retail bankruptcy in US history. https://www.bloomberg.com/news/articles/2017-09-18/toys-r-us-is-said-to-plan-bankruptcy-filing-as-soon-as-today

The Fed announced it will begin to unwind its 4.5 trillion dollar balance sheet, by 10 million per month, starting in October. https://www.theguardian.com/business/live/2017/sep/20/us-federal-reserve-decision-janet-yellen-markets-uk-retail-business-live

Ford will shut 5 of its plants for 10 weeks to work off excess inventory. http://www.businessinsider.com/r-ford-to-cut-production-at-five-north-american-vehicle-plants-2017-9

First Solar was the trade of the week. It closed up just under 2% on Friday. This makes the 4th straight gain for the trade of the week. At one point NVDA was up over 6% before it fell. The big winner was SITO. It close up over 22% in one week.

9/17/2017

Over 143M had their private information compromised in the Equifax hack. https://www.reuters.com/article/us-equifax-cyber/equifax-reveals-hack-that-likely-exposed-data-of-143-million-customers-idUSKCN1BI2VK

Before the Equifax hack was disclosed to the public, executives dumped their stock. http://money.cnn.com/2017/09/08/investing/equifax-stock-insider-sales-hack-data-breach/index.html

Bitcoin crashed from $5000 to $3000 per coin when the Chinese announced they will be closing cypto exchanges by September 30th, 2017. https://www.bloomberg.com/news/articles/2017-09-14/bitcoin-tumbles-as-chinese-exchange-says-it-will-halt-trading

Jamie Diamon piggy backed on that news an called bitcoin a fraud. An even bigger from than the tulip bubble. http://fortune.com/2017/09/12/jamie-dimon-bitcoin-cryptocurrency-fraud-buy/

CPI rose 4/10 of a percent last month due to the increased price of gas. https://mishtalk.com/2017/09/14/cpi-up-on-energy-and-shelter/

The I phone 8 is going to be released soon. It will cost over $1000. http://www.businessinsider.com/is-the-iphone-x-worth-1000-2017-9

Last week Twitter was the trade of the week. TWTR closed up a little over 3%. It was has high as 5% on Thursday. KMPR closed up 4% for the week and BGC was the top gainer up 8% for the week.

9/10/2017

Stanley Fischer is stepping down from his position with the Federal Reserve for personal reasons. https://www.cnbc.com/2017/09/06/stanley-fischer-stepping-down-from-fed-citing-personal-reasons.html

Fed Governor Lael Brainard acknowledged the feds assessment of inflation is incorrect. https://www.mercalia.com/en/news/key-fed-official-just-admitted-central-bank-got-inflation-wrong-and-so-it-may-delay-hike-cnbc

Top US oil importers are going to settle crude oil contracts in gold and Chinese renminbi. https://asia.nikkei.com/Markets/Commodities/China-sees-new-world-order-with-oil-benchmark-backed-by-gold

If the debt ceiling was not raised right away, Moodys threatened to downgrade us debt from its triple a rating. http://www.marketwatch.com/story/moodys-us-can-forget-about-triple-a-rating-if-it-violates-debt-ceiling-2017-09-05

Banks to freeze accounts article by Wolf Richter. https://wolfstreet.com/2017/07/30/leaked-eu-plans-to-freeze-deposits-to-prevent-bank-runs/

Bitcoin and the rest of the cryptocurrencies sold off after the Chinese threatened to make icos illegal. https://www.bloomberg.com/news/articles/2017-09-06/bitcoin-comes-clawing-back-after-selloff-on-china-ruling-chart

Welltower (HCN) was the trade of the week. It closed up 1%. The big winner was RH blasting up 46% for the week. After one full year of putting out a trade of the week, I have learned a couple things. With the system I used stocks that trade over $30 tend to have a steady return. 19 of 25 stocks over $30 closed in positive territory.

9/3/2017

Ford is now disbanding credit scores so more people will be able to have access to car loans. http://www.philstockworld.com/2017/08/26/ford-to-abandon-traditional-credit-scores-for-underwriting-decisions-as-sales-stall/

The average new car loan is now $506 and $386 for a used car per month. https://www.cheatsheet.com/money-career/things-middle-class-cant-afford-anymore.html/?a=viewall

Former Federal Reserve Fed Chair Ben Bernanke, is going to be the keynote speaker at an October crypto currency conference. http://www.zerohedge.com/news/2017-08-27/bernanke-flip-flops-will-be-keynote-speaker-blockchain-conference

Bank of America released a new report. The findings indicated the average amount of all accounts including checking, savings, and retirement accounts only add up to $12,000 per household.

The Federal Reserve has acknowledged the Philips curve is no longer relevant. https://mishtalk.com/2017/08/29/fed-study-shows-phillips-curve-is-useless-admitting-the-obvious/

Green Med is going to have its intimal coin offering. This will marijuana companies to transact easier since most states make it hard for these companies to transact. http://markets.businessinsider.com/news/stocks/GreenMed-Launches-World-s-First-Cryptocurrency-Based-Credit-Card-Processing-App-for-Legal-Marijuana-Industry-1002283551

IBM is now coming out with its own block chain currency to track ingredients from its origin to the grocery store. Companies like Wal-Mart, Kroger, and many other companies will take part in this new tracking system. https://finance.yahoo.com/news/walmart-others-turning-blockchain-food-safety-115906494.html

Warrren Buffet, Bill Gates, and Richard Branson are now funding studies to grow meat in labs. http://www.investopedia.com/news/bill-gates-and-richard-branson-betting-labgrown-meat/

Jacob Rothschild sold off a large amount of US assets in the past couple of weeks. https://thedailycoin.org/2017/08/31/rothschild-just-dumped-massive-amounts-us-assets-sending-ominous-signal/

Generac (GNRC), the trade of the week, closed up 5% for the week. SCO moved as high as 7% by Tuesday and closed slightly negative. Richmont Mines (RIC) was the big gainer closing up 15% for the week.

8/27/2017

According to a recent 13 F filing the Rothschild’s have gotten rid of the US dollar and the S&P 500 index and moved it into the Sterling and Euro. They allocated some capital to the energy sector.

Ron Paul’s YouTube channel has now been demonetized.

Jackson Hole meeting is taking place this week.

IBM is now creating its own block chain to track food ingredients. Many major companies have agreed to team up with them on this initiative.

Citi Group issued a warning to their clients about a potential down turn in the near future.

Generac Holdings Inc (GNRC) manufactures generators. After hurricane Sandy this stock moved from the low $20 range to almost $60. Average trading volume has doubled in the past two trading days. On Friday GNRC closed above its 200 day moving average.

Stocks to watch – RIC, SCO, and RSO

8/20/2017

There is talk of Judy Shelton becoming a voting member of the Fed. She is a fan of sound money, which means gold.

Platinum to Gold ratio is at a 35 year low.

India typically known for their gold buying are now purchasing large amounts of silver.

Four out of ten new home buyers have less than a 10% down payment.

Wal Mart is competing with Amazon for the patent to a floating warehouse.

Uranium Energy (UEC) has fallen over 25% in the past month. Last week it tested and held $1.30 multiple times. The rsi is week at the moment but it may change quickly with a cross above its 200 day moving average of $1.37.

Stocks to watch USO, HCN, and LABU

8/13/2017

Labor market condition index will no longer be used by the Federal Reserve. http://www.marketwatch.com/story/fed-ends-release-of-its-own-employment-yardstick-2017-08-07

Charles Schwab has new brokerage accounts opening at a rapid pace. Mostly millennials are coming into the market. Is this considered the dumb money entering the market while the smart money is leaving? http://www.onestopbrokers.com/2017/08/11/dumb-dumber-money-keeps-pouring/

Jeff Gundlach stated the volatility index should double by December, Warren Buffet is sitting on over 100 billion in cash, and Jim Rogers, who is normally very reserved said “ A major crisis is less than a year away. http://www.financialexpress.com/market/jim-rogers-says-the-biggest-crisis-in-his-life-is-less-than-a-year-away/802645/

Vegas odds have been released for the next presidential election in 2020. Donald Trump is the front runner so far at +300. Mike Pence is a +700, Elizabeth Warren is a +900. The long shot is George Clooney at +30,000. http://www.thecommonsenseshow.com/2017/08/07/vegas-oddsmakers-have-handicapped-the-presidential-winner-in-2020-who-will-win/

China will use blockchain to collect taxes from their citizens. http://thedailycoin.org/2017/08/06/china-will-use-blockchain-collect-taxes/

Four silver mines had decreasing production so far in 2017. Decreases ranged from 20-34%. Falling orr grade was the main reason. http://thedailycoin.org/2017/08/06/china-will-use-blockchain-collect-taxes/

Record buying came into to ticker VXX. This etn tracks the volatility index. VXX jumped 22% last week. This volume could be cause by Jeff Gundlach’s comments.

Wayfair inc (W) was the trade of the week. Bad earnings were reported this week for Wayfair and drove the stock down 13%. Stay away from earnings releases if you are a trader. BZUN closed the week up over 2% and TSLA closed the week flat after if moved up over 3% on Thursday.

8/6/2017

The bitcoin fork was complete on August 1st. In addition to bitcoin there is also bitcoin cash. Bitcoin is currently trading neat $3200 while bitcoin cash is priced at $200. https://www.moneymorning.com.au/20170802/bitcoin-fork-official-bitcoin-cash-price-up-32.html

Saudi Arabia oil imports are steadily decreasing as us production is on the rise. http://www.foxbusiness.com/features/2017/08/03/oil-prices-fall-further-ahead-u-s-rig-data.html

The vix continues to its downward trend now trading at a 24 year low. http://www.businessinsider.com/stock-market-today-vix-volatility-2017-7

Alan Greenspan did an interview where he foresees the economy dealing stagflation comparable to what took place in 1979. He proclaimed the bond market is the issue. https://thedailycoin.org/2017/08/02/greenspan-warns-stagflation-like-1970s-not-good-asset-prices/

Debbie Wasserman Schultz’s brother is going to oversee the investigation of the Irwin Awan. He is the head of IT for the DNC. http://thedailycoin.org/2017/07/30/steve-wasserman-debbies-brother-oversee-awan-probe-video/

The Dow Jones closed in record territory while the gold to silver ratio climbed over 77:1. https://www.nytimes.com/reuters/2017/08/03/business/03reuters-usa-stocks.html

AU Anglogold Ashanti went straight down last week after the jobs report. It closed down 10%. That was a good reminder of why I typically pick stocks that are trading above their 200 day moving average. If stocks are trading under their 200 day moving average wall street is usually betting against them. LYSCF spiked up 15% on Monday morning but closed the week up just under 3%. INTC also closed the week up just under 3%.

7/30/2017

Former plunge protection team member Pippa Malmgren publicly stated governments are worried about the power of block chain currencies. Currently only only 3% of of retail investors have exposure to crypto currencies. https://www.lewrockwell.com/2017/07/tyler-durden/blockchain-freaking-governments/

Marin Katusa released an article talking about the continuing decline in new gold discoveries. You combine that with Taho Resources having a class action lawsuit filed against them and the recent commitment of traders report indicates golds downside may be limited. https://www.ainsliebullion.com.au/mobile/gold-silver-bullion-news/marin-katusa-talks-gold-deposits-after-a-disappointing-nar-report/tabid/155/a/1586/default.aspx

The median existing home price hit a new record high in July at $263,000. This is up 6.5% year over year. Low inventory and high prices homes are pushing that number up. https://www.cnbc.com/2017/07/24/june-us-existing-home-sales.html

Oil rose quickly last week despite the fact the OPEC produced record amounts. The US will soon pass Russia for the amount of oil produced within the next year. I would guess shortly oil prices will correct to the downside. https://money.usnews.com/investing/news/articles/2017-07-24/opec-non-opec-debate-how-to-cap-rising-libyan-nigerian-oil-output

The libor rate is the interbank lending rate. Last week it was made public this bench mark lending rate will be phased out by 2021. http://www.marketwatch.com/story/scandal-hit-libor-to-be-phased-out-2017-07-27

Imran Awan, the IT director for the DNC was arrested at Dulles Airport. He was attempting to flee the country and head back to Pakistan. http://www.marketwatch.com/story/scandal-hit-libor-to-be-phased-out-2017-07-27

Abbvie Inc (ABBV) closed the week down 5%. It is still a stock to keep on your radar this week. It is sitting just above its 50 day moving average at $70.44. IRBT closed the week up 20%.

7/23/2017

The bitcoin fork will take place on August 1st http://www.cnbc.com/2017/07/18/bitcoin-soars-as-miners-move-to-solve-the-digital-currency-scaling-problem.html

UUP the etf for trading the us dollar has hit close to a one year low trading at $24.32. It is still above its 200 day moving average. http://www.cnbc.com/video/2017/07/20/dollar-index-hits-11-month-low.html

Veritasium will trade in competition with the Jamaican stock exchange. This will take place sometime August.

At a recent Visa conference, the company announced it would give companies that quit doing business in cash $10,000. http://nypost.com/2017/07/15/visa-offers-small-businesses-10k-to-ban-cash/

The amount of shorts on the gold cot report by commercial banks are significantly lower since the flash crash that occurred a couple weeks ago. Commercials loosening up on their short position means a better outlook for the precious metals. JP Morgan is always on the right side of the trade when it comes to silver. http://cotbase.com/

Mario Draghi is talking more QE while Japanese banking officials said they will never raise rates again. http://www.newsmax.com/Finance/Markets/draghi-ecb-stimulus-bank-of-england/2017/07/20/id/802761/

AT&T ditching landline services in Illinois telling existing customers to get cell phones. http://www.chicagotribune.com/business/ct-att-landline-end-illinois-0706-biz-20170705-story.html

Universal Display (OLED) did well as the trade of the week closing up over 3%. 3 out of the other 4 set ups closed positive for the week.

7/16/2017

Senate Bill 1241, originated by Chuck Grassley has some in the crypto currency world concerned. Section 13th of the combating money laundering and terrorist financing bill, states civil asset forfeiture of monetary assets, cash, gift cards, and digital currencies. https://news.bitcoin.com/prepare-for-sb1241s-pit-bull-assault-on-bitcoin-freedom/

In Zurich, Switzerland digital passport ids are being created using the ethereum technology platform. https://www.cryptocoinsnews.com/bitcoin-friendly-swiss-city-announces-ethereum-digital-id-pilot/

The second largest producing silver mine, Taho Resources, has been temporarily shut down due to government interference. Yet the price of spot silver somehow drops. https://srsroccoreport.com/worlds-2nd-largest-silver-mine-shut-down-implications-for-company-market/

Mike Maloney produced a video show how credit is beginning to roll over. https://www.youtube.com/watch?v=oL1rHS4ex-g

The Bank of Japan recently stated it will now monetize unlimited amounts of Japanese Government Bonds. http://www.reuters.com/article/us-japan-bonds-idUSKBN19S0YI

After the fed meeting on Wednesday, a chance of a September rate hike fell from 18% to 13% http://www.cnbc.com/2017/07/14/fed-janet-yellen-may-delay-interest-rate-hike-after-cpi-retail-data.html

Warren Buffet has been out promoting the Indian stock market as it continues to run higher. http://www.businessinsider.com/warren-buffett-jeff-gundlach-favorite-stock-market-a-powerful-boost-2017-7

All the stocks recommended last week closed the week in positive territory. Stryker Corp. (SYK) closed the week up 3%. NVDA was the big winner gaining 12%. VEEV and LITE both closed up 3%, while AAL gained 1% for the week.

7/9/2017

Janet Yellen is scheduled to Testify to congress next week on Wednesday. The head of the central bank will field questions from the representatives. https://money.usnews.com/investing/news/articles/2017-07-06/feds-yellen-to-deliver-second-day-of-testimony-on-july-13

Ray Dalio recently comented on the end of the central bank era. https://www.bloomberg.com/news/articles/2017-07-07/dalio-calls-end-of-central-bank-era-time-to-head-to-party-exit

Silver had a fat fingered trade where the price dropped from $16.15 to $14.34 in a matter of seconds. That pushed the gold to silver ratio up to 78/1. That is the highest ratio since April of 2016. Gold closed the week at $1212.82 while silver closed at $15.60. http://www.businessinsider.com/silver-spot-price-crash-2017-7?IR=T

There is talk AT&T is going to buy out Time Warner. If that was so CNN whiched is owned by Time Warner have to rebrand itself. http://www.businessinsider.com/silver-spot-price-crash-2017-7?IR=T

The new I Phone 8 is going to be released with a sticker price of $1,000. http://www.businessinsider.com/iphone-8-will-have-carrier-discounts-analysts-say-2017-7

Auto loans reached a new high in amount borrowed and time to pay off. Loans averaged 69 months to pay off, with the average loan amount totaling $30,900. That makes the average payment per month $517. http://money.cnn.com/2017/07/03/autos/long-auto-loans/index.html

STAG was the trade of the week and it closed down 1%. All the other setups closed in positive territory. TRUE was up 2%, AAL gained 5%, and NOAH increased over 6%.

7/2/2017

Porter Stansberry and Steve Sjuggerud released an interview last week. It highlights the opportunity to invest in emerging market tech companies. They also discussed what corporate debt looks like in the US and how you can subscribe to their services. Last week the MSCI will allow the China A shares into their emerging market index starting in 2018. https://www.advisorperspectives.com/commentaries/2017/06/26/msci-to-add-china-a-shares-to-emerging-markets-index-what-does-it-mean-for-investors?channel=Capital%20Growth

Japan is expiring days where no bonds are traded. Should it be surprise this is one of the major counties interested in doing business with bitcoin. http://www.zerohedge.com/news/2014-06-10/japanese-bond-futures-volume-collapses-zero-even-service-sector-implodes

Fannie Mae mortgage lenders sentiment survey has lenders concerned. With the median new home price going for over $400,000 and the average mortgage borrower only making $63,000 of income. http://money.usnews.com/investing/news/articles/2017-06-26/us-home-lenders-see-leaner-times-ahead-fannie-mae-survey

Bank stress tests were completed last week. All 34 firms past for the first time since the financial crisis. http://nypost.com/2017/06/28/all-banks-pass-stress-test-for-first-time-since-financial-crisis/

Yandex N.V. (YNDX) was one of the worst trades of the week recommendations in some time. It closed the week down almost 5%. AMN closed the week up 4%.

6/25/2017

Ethereum experienced its first flash crash. The currency was trading at $315 and instantly fell to $13. http://www.businessinsider.com/ethereum-price-flash-crash-2017-6